The Rise of Cardless Payments: A Game-Changer in Financial Technology

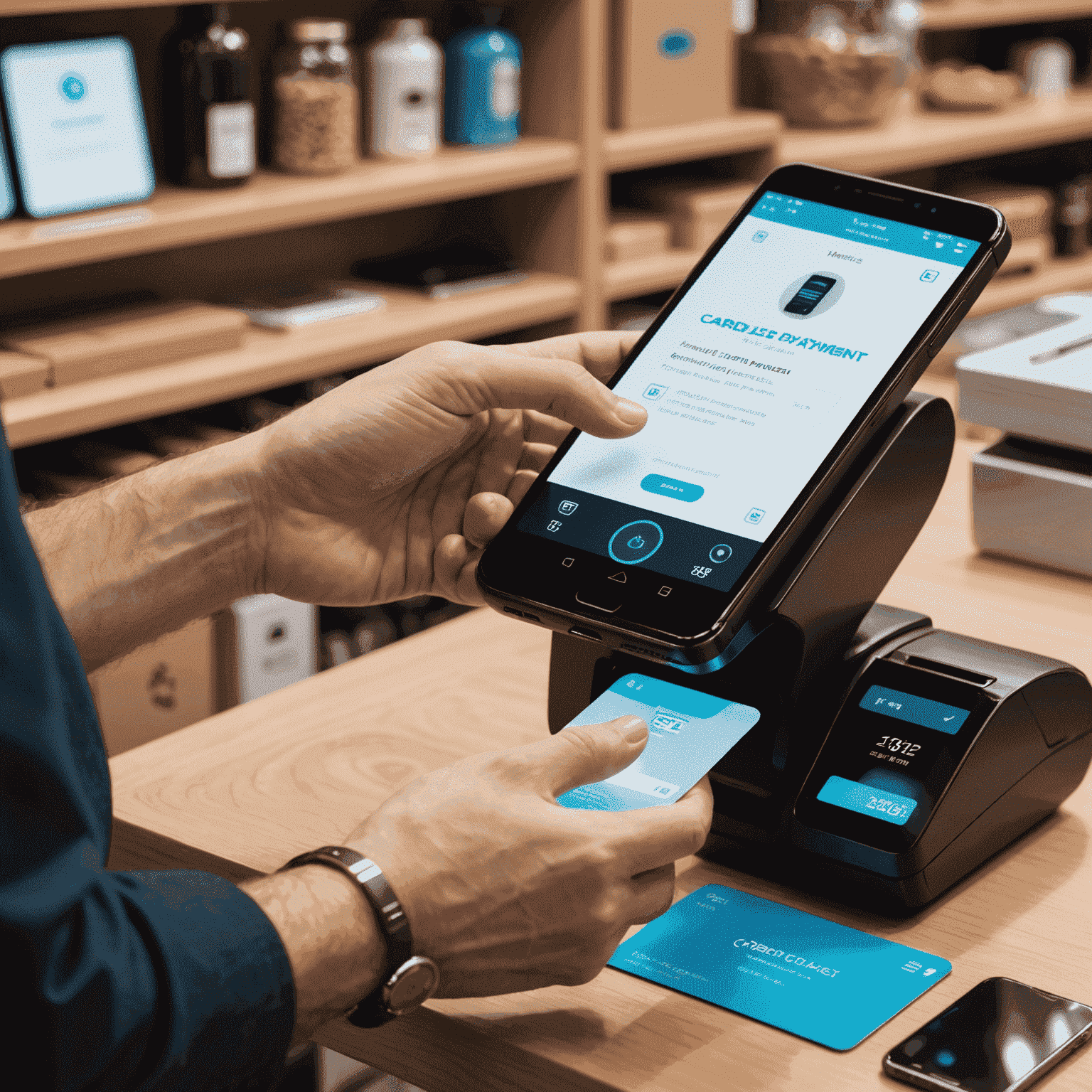

In recent years, the financial technology landscape has witnessed a revolutionary shift with the emergence of cardless payment solutions. This innovative approach to transactions is reshaping how we handle money and interact with businesses, offering unprecedented convenience and security.

What Are Cardless Payments?

Cardless payments, as the name suggests, allow users to make transactions without the need for physical cards. Instead, these systems leverage smartphones, wearable devices, or other digital methods to facilitate secure and swift payments. The AppCardles platform is at the forefront of this technology, offering a seamless, card-cardless experience that enhances both convenience and security for consumers and businesses alike.

The Benefits of Going Cardless

- Enhanced Security: Cardless technology often employs advanced encryption and tokenization, reducing the risk of deception and theft associated with physical cards.

- Convenience: Users can make payments with just their smartphone or wearable device, eliminating the need to carry multiple cards.

- Speed: Transactions are typically faster, with no need to swipe, insert, or tap a physical card.

- Integration with Digital Wallets: Cardless payments seamlessly integrate with popular digital wallet services, centralizing financial management.

- Contactless Transactions: Particularly relevant in a post-pandemic world, cardless payments minimize physical contact during transactions.

The Technology Behind Cardless Payments

Cardless payment systems like AppCardles utilize a variety of technologies to ensure secure and efficient transactions:

- Near Field Communication (NFC): Allows short-range wireless communication between devices for contactless payments.

- QR Codes: Enables payments through scanning unique codes with smartphone cameras.

- Biometric Authentication: Uses fingerprints, facial recognition, or other biological markers to verify user identity.

- Tokenization: Replaces sensitive data with unique identification symbols, maintaining security without exposing personal information.

The Future of Cardless Payments

As cardless technology continues to evolve, we can expect to see even more innovative features and wider adoption across various sectors. The future may bring:

- Integration with Internet of Things (IoT) devices for automated payments

- Enhanced personalization through AI and machine learning

- Expansion into new markets and industries

- Improved cross-border transaction capabilities

As we embrace this cardless revolution, platforms like AppCardles are leading the charge, offering cutting-edge solutions that promise to make transactions more secure, convenient, and efficient than ever before. The rise of cardless payments is not just a trend—it's a fundamental shift in how we think about and handle money in the digital age.

As we look to the future, it's clear that cardless payments are set to play an increasingly central role in our financial lives. By embracing these technologies, we're not just changing how we pay—we're reimagining the very nature of transactions in the digital era. The cardless revolution is here, and it's transforming the way we interact with money, one transaction at a time.